Bangladesh’s economy has grown at a phenomenal rate in the last decade. From being one of the few countries to sustain a positive growth rate of 6.94 percent in 2021 during the COVID-19 pandemic; it has now started to show symptoms ranging from declining foreign exchange reserves to demand-supply gaps in the energy markets which could stall its impressive growth trajectory. Among these, the rising divergences in the government’s fiscal balance alongside the precarious Balance of Payments situation in the country need urgent attention.

In recent years, Bangladesh is witnessing a mild increase in government budget deficits in recent times, especially since 2016. While the government has successfully tried to keep the deficit at around 5 percent of GDP as per the ‘Public Money and Budget Management Act 2009’, the actual budget deficit accounted for about 5.5 percent of GDP in 2019-2020 as compared to 3.4 percent in 2016-2017. The government released Tk 1.28 trillion as a stimulus package amounting to about 4.4 percent of the GDP to address the health and economic crisis caused by the COVID-19 pandemic which substantially burdened the exchequer like most countries across the world. This was done via spending on health infrastructure, provisioning of loans at lower rates of interest, spending on social security programs, and expansionary monetary as well as fiscal policy among others.

Table 1: Overall Budget Balance and Financing in Bangladesh (as percentage of GDP) (2014-2021)

| Budget balance/ financing | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 | 2019-20 | 2020-21 |

| Overall budget balance (excluding foreign grants) | -5.03 | -5.03 | -4.99 | -4.98 | -4.95 | -5.49 | -6.10 |

| Overall budget balance (including foreign grants) | -4.66 | -4.74 | -4.76 | -4.78 | -4.80 | -5.37 | -5.60 |

| Net domestic financing | 3.61 | 3.59 | 3.54 | 2.93 | 3.1 | 3.48 | 3.73 |

| Net foreign financing (excluding grants) | 1.05 | 1.15 | 1.22 | 1.85 | 1.71 | 1.88 | 2.37 |

| Net foreign financing (including grants) | 1.42 | 1.44 | 1.46 | 2.05 | 1.86 | 2.01 | 2.17 |

Source: Fiscal Policy and Financial Management, Bangladesh Economic Review 2021

Tax Administration

Even though the overall expenditure of the government in 2020-21 was less than the pre-pandemic era, at 17.46 percent of GDP as compared to 17.87 percent and 18 percent in 2019 and 2018 respectively, the dampened Value Added Tax (VAT), import, custom duties, and supplementary duties due to restrictions in trade mobility and demand contraction, reduced the tax revenue from the National Board of Revenue (NBR) sources by 2.73 percent in FY 2019-20 in comparison to FY 2018-19. Notwithstanding this, Bangladesh’s revenue mobilisation in FY 2019-2020 increased by 5.53 percent, due to a phenomenal rise in non-tax revenue by 63.77 percent with respect to FY 2018-19.

Although mainstream economic theory suggests that lower taxes could enhance disposable incomes and money circulation in the economy, in turn spurring economic growth—one of the major red flags for Bangladesh remains that it has one of the lowest tax-to-GDP ratios in the entire region which may hamper the revenue mobilisation targets in the medium to long-term. Among the seven Bay of Bengal Initiative for Multi-Sectoral Technical and Economic Cooperation (BIMSTEC) nations, Bangladesh has the second lowest tax-to-GDP ratio of 7 percent (2020) followed by Myanmar at 6.4 percent (2019) – while the values for Nepal, Thailand, Bhutan, India, and Sri Lanka stood at 15.8 percent (2020), 14.5 percent (2020), 13 percent (2020), 12 percent (2018), and 8.1 percent (2020), respectively. Additionally, illicit financial flows, including tax evasion have been a menace for Bangladesh in the last few decades. Rampant corruption, the politicisation of tax authorities and the lack of skilled manpower in the NBR are cited as the main reasons for the tax collection issues in the country. The Finance Act of 2011 has attempted to incorporate provisions for alternative dispute resolutions with respect to VAT, income tax, and customs disputes.

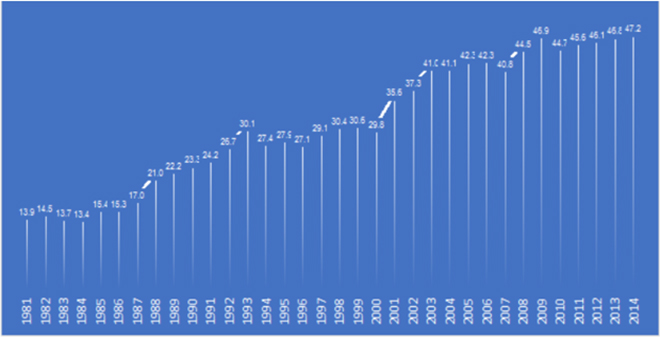

Figure 1: Tax evasion (as percentage of GDP) in Bangladesh (1981–2014)

Capital Expenditure

Bangladesh’s massive infrastructural investments are testimony to the fact that physical capital formation is essential for any economy to diversify, grow, and become resilient in the long run. In consonance with an impressive growth rate in the last few years, Bangladesh recognises the importance of ameliorating infrastructural bottlenecks to catalyse economic growth in the country. The Dhaka Chamber of Commerce and Industry notes that the country will need to invest approximately US$ 25 billion annually until 2030 to meet the infrastructural requirements. However, complaints of corruption in the public sector, ambitious vanity projects, and inflated costs of infrastructure have added more burden on government expenditures, significantly contributing to the present-day macroeconomic precarity in the country. In only five years, from 2016-17 to 2020-21, the development expenditure in Bangladesh has increased from Tk 880.90 billion (4.46 percent of GDP) to 2079.88 billion (6.74 percent of GDP).

Despite some of the earlier developments, Bangladesh’s transport system is still considered to be one of the poorest in the world. Various connectivity projects have been initiated since 2009 when the Sheikh Hasina government came to power—such as the Padma Multipurpose Bridge, the Dhaka Metro Rail, and Dhaka Elevated Expressway. While some of these have been stalled due to the pandemic in 2020, other reasons such as increased cost of raw materials, bureaucratic delays, and problems in land acquisitions have substantially contributed to their deferment and have also led to cost overruns. Apart from this, subsidies to power and petroleum corporations rose steeply between 2010 to 2021. Recently, the Russia-Ukraine war has contributed to the rise in the prices of energy, raw materials, and food, thus stalling many government-funded infrastructural projects, leading to further costs, dampening developmental action, and creating additional hikes in the fiscal deficits.

Given the importance associated with capital enhancement in Bangladesh, the role of private sector investments is undeniable. While private sector investment in Bangladesh as a percentage of GDP has risen by 5 percentage points in the last two decades, its share with respect to total investment has dropped while the public sector’s share has risen. Inadequate infrastructure and substandard transportation system, low return on assets and high transaction costs of doing business as a result of corruption have also acted as constraints in the private sector. On top of this, the banking sector in Bangladesh is crippled by non-performing loans and financial scams for some time now. In fact, in 2019 the Central Bank estimated the total amount of defaulted loans at US$ 11.11 billion, which the IMF contested, claiming that the figure could be more than double this.

Given the current economic vulnerabilities in Bangladesh, coupled with a steep rise in pandemic-induced expenses on various welfare measures and frictions on resource mobilisation had widened the budgetary deficit and increased the dependence on external debts for the Bangladesh economy. The country needs to urgently focus on effective methods for revenue enhancement and mobilisation as well as expenditure rationalisation to ameliorate these budgetary problems in the near future.