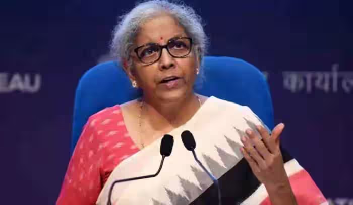

The 55th GST Council meeting chaired by Union Finance Minister Nirmala Sitharaman proposed several key recommendations to simplify tax procedures and provide relief to taxpayers, including individuals and businesses.

A Closer Look at the Key Decisions:

What’s Getting Cheaper?

– Fortified Rice Kernels (FRK): The GST on Fortified Rice Kernels (FRK) has been reduced to 5 per cent when supplied through the Public Distribution System (PDS) to benefit weaker sections of society.

– Gene Therapy: Gene Therapy has been fully exempted from GST. This makes advanced medical treatments more affordable.

– Food Preparations for Free Distribution: Inputs for food distributed under government schemes for economically weaker sections will now attract a reduced 5 per cent GST rate.

– Long Range Surface-to-Air Missile (LRSAM) Assembly: Exemption from Integrated Goods and Services Tax (IGST) on systems, sub-systems, and tools used for LRSAM manufacturing, aiding the defense sector.

– Inspection Equipment for IAEA: IGST exemption on imports of equipment and consumable samples for International Atomic Energy Agency (IAEA) inspections, supporting international compliance efforts.

– Pepper and Raisins (Direct Sales): Clarified as not liable to GST when sold directly by agriculturists, offering relief to agricultural producers.

What’s Getting Costlier?

– Old and Used Vehicles (Including EVs): GST increased from 12 per cent to 18 per cent on all old and used vehicles, except for certain petrol and diesel variants.

– Ready-to-Eat Popcorn: Pre-packed and labelled snacks will now attract 12 per cent GST.

- Caramelized popcorn will attract 18 per cent GST.

- Popcorn mixed with salt and spices, classified as namkeens, will continue to attract 5% GST if not pre-packaged and labelled.

– Autoclaved Aerated Concrete (ACC) Blocks: GST of 12 per cent will apply if the blocks contain more than 50 per cent fly ash content.

– Sponsorship Services by Corporates: Now under the Forward Charge Mechanism, potentially increasing costs for corporate sponsors.

– Penalty-Only Appeals: Higher pre-deposit required for penalty-only appeals under the Appellate Authority.

Other Key Changes

– Vouchers: No GST will apply to voucher transactions, as they are not considered a supply of goods or services.

– Penal Charges: Penalties collected by banks and NBFCs for non-compliance with loan terms will no longer attract GST.

– Definition Update for Pre-Packaged and Labelled Goods: The Council has recommended revising the definition to include all retail commodities pre-packed (up to 25 kg or 25 liters) as per the Legal Metrology Act. These goods must carry declarations mandated under the Act and its rules.