The GST Council at its 49th meeting decided to clear all pending dues of states pertaining to GST compensation. The Council also approved reducing the GST rates on liquid jaggery or raab, pencil sharpeners and certain tracking devices.

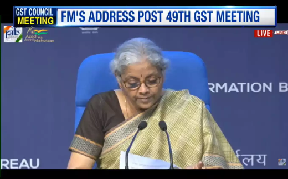

Addressing a press conference after the Council’s meeting, Finance Minister Nirmala Sitharaman said that some of the compensation dues that were pending for the month of June will be cleared today itself. The funds will be released from the consolidated fund of India and recouped later, she added.

Revenue Secretary Sanjay Malhotra said 50 percent of the provisional GST compensation cess amount was released earlier. Now, 50 percent amounting to Rs 16,982 crore is being released to 23 states. He further said that once certified figures are available, another Rs 16,524 crore will be released to six states.

Rates on liquid jaggery or sugarcane raab has been brought to nil from 18 percent earlier if sold in loose form. In case it is pre-packaged, the rate has been reduced to 5 percent. GST rate on pencil sharpeners is cut to 12 percent from earlier 18 percent.

Rate on tax trackers is lowered to 12 percent from 18 percent, subject to certain conditions. Services provided by courts will be charged at Reverse Change Mechanism (RCM).