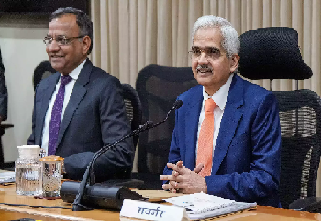

The Reserve Bank of India (RBI) Monetary Policy Committee (MPC) met during April 3-6, 2023. The meeting, chaired by RBI Governor Shaktikanta Das, was attended by all the members – Shashanka Bhide, Ashima Goyal, Jayanth R. Varma, Rajiv Ranjan, Michael Debabrata Patra.

The central bank released the minutes of the RBI’s 42nd MPC meeting on Thursday, April 20. The next meeting of the MPC is scheduled during June 6-8, 2023

Here are the key highlights of the meeting:

-The MPC kept the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50%.

The Liquidity Adjustment Facility (LAF) is a monetary policy tool used by the Reserve Bank of India (RBI) to manage short-term liquidity and to regulate money supply in the economy. The LAF operates through the repo and reverse repo rate mechanism, where repo (repurchase agreement) is the sale of securities to the RBI by banks in exchange for funds to meet their short-term liquidity needs, while reverse repo is the purchase of securities by the RBI from banks in exchange for funds, which helps to absorb excess liquidity in the system. The LAF is used to signal the monetary policy stance of the RBI and to manage inflation and interest rates in the economy.

– The standing deposit facility (SDF) rate remains unchanged at 6.25% and the marginal standing facility (MSF) rate and the Bank Rate at 6.75%.

The SDF is an overnight fixed deposit facility that allows banks to park their excess funds with the RBI at a predetermined interest rate. The SDF rate is generally set 25 basis points below the repo rate, which is the rate at which banks can borrow short-term funds from the RBI. The SDF is used to absorb excess liquidity in the system and to prevent banks from lending out more money than is available to them. The MSF, on the other hand, is an overnight borrowing facility that allows banks to borrow funds from the RBI against the collateral of government securities. The MSF rate is set at a premium of 100 basis points above the repo rate, which makes it a more expensive source of funding for banks. The MSF is used by banks in case of a short-term liquidity crunch or when they are unable to borrow from other sources. The MSF ensures that banks always have access to funds at a higher cost, which serves as a disincentive for them to rely too heavily on short-term borrowing and to maintain adequate liquidity buffers.

-The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

-“These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4% within a band of +/- 2 per cent, while supporting growth” according to the MPC minutes released by the RBI today.

On economy

India’s real GDP growth is estimated at 7.0% for 2022-23 according to the second advance estimates released by the NSO. Private consumption and public investment were key drivers, while industrial production and services showed strength in Q4. Rabi foodgrains production is expected to increase by 6.2% and purchasing managers’ indices point towards sustained expansion. However, merchandise exports and non-oil non-gold imports contracted in February while services exports continued to grow.

RBI MPC inflation outlook

The Reserve Bank of India (RBI) has projected CPI inflation at 5.2% for 2023-24, taking into account factors such as record foodgrains production, unseasonal rains, high milk input costs, and uncertain crude oil prices. The RBI is also optimistic about the future outlook due to strong rural demand, buoyancy in contact-intensive services, and government expenditure. However, the MPC remains focused on aligning inflation with the target and keeping prices stable to sustain economic activity. The policy repo rate has been kept unchanged at 6.50%, with readiness to act if necessary. The MPC will continue to monitor inflation and growth outlook and withdraw accommodation to ensure alignment with the target while supporting growth.

All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 6.50%.