The International Labour Organization (ILO) defines social security as the “protection that a society provides to individuals and households to ensure access to healthcare and to guarantee income security, particularly in cases of old age, unemployment, sickness, invalidity, work injury, maternity or loss of a breadwinner.” Essentially, social security provides the underprivileged sections of a society with a safety net to tide over crises, enable redistribution of income, diversify economic risks, and promote social stability and economic growth.

When looking at the nature of existing social security systems in the G20 countries, we see that most have targeted social protection schemes, while some have universal social security. There is significant variation in the nature of these programmes. For instance, India has an old age pension system that is fully funded by the government, while a pension for disability caused by workplace injuries is a contributory scheme with no government participation. Brazil and the United Kingdom (UK) have a contributory system for a workplace disability pension as well, but the government covers any deficit that arises. The same is seen in Saudi Arabia where the government covers any actuarial deficit. In the United States (US), however, the government plays no role, and, in most states, it is the employer that bears the total cost.

When looking at maternity benefits, the Japanese government contributes 50 percent while the insured person contributes the rest. In South Korea, the employer and employee contribute jointly to maternity insurance and the government extends subsidies as required. The following table provides a comparison of the nature of various social security programmes from some selected G20 economies.

Table 1: Nature of Social Security Programmes (India, US, UK, Germany)

| Type of Social Security | India | US | UK | Germany |

| Child | Data Unavailable | Data Unavailable | 100 percent government funded | 100 percent government funded |

| Maternity | 100 percent government funded | None | 92 – 100 percent funded by the government | Government contributes a flat rate, rest from employer and employee |

| Unemployment | 100 days of work provided by the government | Government covers administrative costs | Contributory, government covers the deficit | 100 percent government funded |

| Old-Age Pension | 100 percent government funded | 100 percent government funded | 100 percent government funded | Covered by the government, employee and employer |

Source: Authors’ own, data from International Labour Organization

Divergences in Social Security Coverage

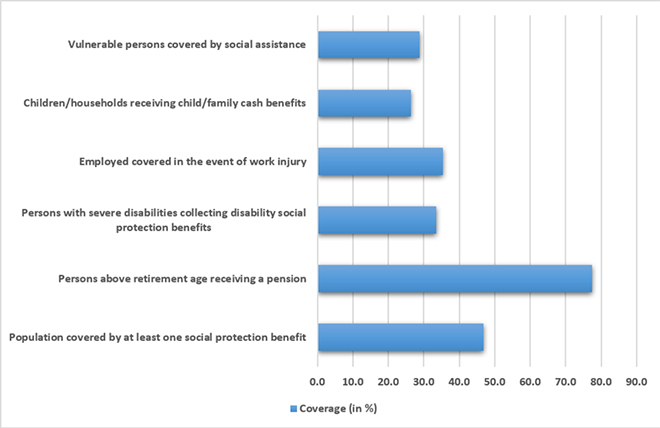

The coverage of social security programmes globally has been quite poor. It is found that less than 40 percent of workers are covered by some form of workplace injury protection scheme. Similarly, only about 30 percent of the global vulnerable population is receiving some form of social assistance from the state, as seen in the following figure. Additionally, there exists a huge global disparity between developing and advanced nations when it comes to coverage of social security schemes. In high-income countries, almost 100 percent of the population received some form of old age pension while this figure is less than 25 percent in low-income countries.

Figure 1: Population Coverage of Various Social Security Programmes (2020)

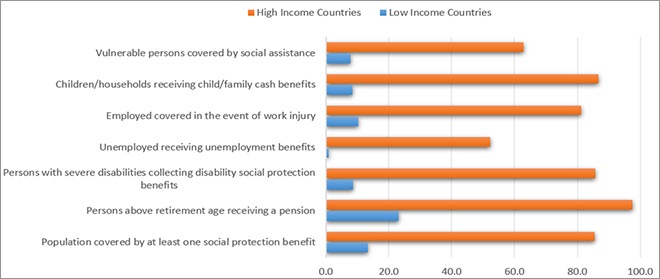

Overall, the population receiving some social protection benefits is only around 20 percent and the percentage of vulnerable populations in these countries covered in some social assistance schemes is less than 10 percent, as can be seen in the following figure. This divergence in social assistance programmes is true for the G20 nations as well, with the G20 Rome Leaders’ declaration in October 2021 aiming “to reduce inequalities, eradicate poverty, support worker transitions, and reintegration in labour markets and promote inclusive and sustainable growth,” to strengthen social protection systems by using a human-centric policy approach.

Figure 2: Social Security Coverage in High-income and Low-income Countries (2020)

Social security in the post-pandemic world

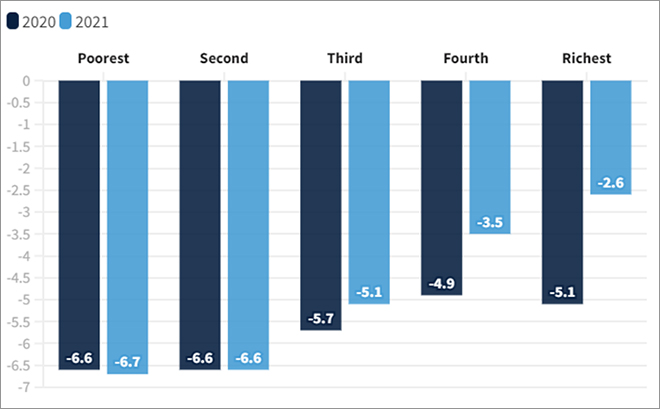

The expansion of social security nets results in a win-win situation as it would bolster long-term growth at the macroeconomic levels on one hand, while also acting as a stabiliser for the sub-national economies by retaining the demand for local goods and services, and enabling creation of jobs and earnings during times of crises, such as the COVID-19 pandemic. In fact, the social security question became crucial during the COVID-19 pandemic. As seen in the following figure, the bottom 40 percent of the population lost 6.7 percent of their income while the top 40 percent lost only 2.7 percent of their income in 2021. As unemployment increased and incomes plummeted, social security was necessary to correct the demand-supply dynamics in both the factor and product markets.

Figure 3: Percent of Income Loss (by global income quintile) due to COVID-19

Despite this, in the last few years there has been a noticeable improvement in the coverage of social security systems for the poorest strata of the population in G20 countries. As a result of this, poverty rates have declined, and larger proportions of the population are able to access services such as healthcare and education; as well as reap the benefits of energy access and technological advancements.

A well-designed social security programme must incorporate a varying set of tools that will cater to the requirements of the target groups individuals or the family. The policies will have to be fine-tuned to account for the differences in socio-economic factors such as gender, age, source of income and type of employment, among others. The effects of the pandemic as well as other exogenous shocks caused by the Russia-Ukraine War have caused soaring inflation in various nations, stretching the finances of developing and underdeveloped nations. This calls for effective expenditure rationalisation as well as revenue mobilisation measures to ensure that the financing of social security mechanisms remains sustainable in the long horizon.

The effects of the pandemic as well as other exogenous shocks caused by the Russia-Ukraine War have caused soaring inflation in various nations, stretching the finances of developing and underdeveloped nations.

To be sure, enhancing the social security systems helps the G20 nations inch closer to the UN Sustainable Development Goals (SDGs). Unfortunately, none of the G20 member nations is showing good progress in meeting these goals by 2030. There are various shortcomings ranging from inadequacy in finances to stop-gap crisis management measures that may be responsible for this. However, devising sustainable models of social security systems and expanding their coverage should be an imperative agenda for the G20, not only for boosting progress towards the SDGs, but also imbibing long-term resilience in domestic and regional economies in the post-pandemic world.

India has a rich experience in social assistance schemes such as the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA)—the world’s largest public works programme providing 100 days of guaranteed employment. India’s G20 presidency will be crucial in sharing its learnings of poverty alleviation and representing the other critical concerns of the Global South. Finally, it is important to note that while the efficacy of social security systems in advancing national and international goals is unquestionable, the incorporation of sustainable financing models in the design of these systems remains a crucial aspect for addressing the gaps in funding.